As the Italian government failed in their desperate attempts this weekend to borrow cash from China and the Middle East (the only places on earth capable of buying their astronomical debt load) and Spain considering seeking an international bailout, British ministers privately warned that the break-up of the euro, once considered impossible, is now accelerating rapidly into a terrifying reality. Diplomats are preparing to help Britons around the world through a colossal banking collapse and even riots arising from the debt crisis. The Treasury confirmed earlier this month that contingency planning for a collapse is now under way.

A senior government minister has also confirmed the extent of the government’s deep concern, saying that Britain is now planning on the basis that a euro collapse is now just a matter of time. “It’s in our interests that they keep playing for time because that gives us more time to prepare,” the minister told the Daily Telegraph. Diplomats have also been told to prepare to help tens of thousands of British citizens in eurozone countries with the consequences of a financial collapse that would leave them unable to access bank accounts or even withdraw cash from paralyzed or collapsed financial institutions.

Recent Foreign and Commonwealth Office instructions to embassies and consulates request contingency planning for extreme scenarios including riots and chaotic unrest. Greece has seen several outbreaks of civil disorder as its government struggles with its huge debts, and British officials are preparing for the exact same outcome. Fuelling the fears of financial markets for the euro, reports in Madrid yesterday suggested that the new Popular Party government could seek a bailout from either the European Union rescue fund or the International Monetary Fund.

Italy is, by far, the biggest cause for alarm — their new government was forced to pay record interest rates on new bonds issued last Thursday November 24th, 2011. The yield on new six-month loans was 6.5 per cent, nearly double last month’s rate. And the yield on outstanding two-year loans was 7.8 per cent, well above the level considered unsustainable. Italy’s new government will have to sell more than €30 billion of new bonds by the end of January to refinance its debts, and analysts feel there is only a small chance that investors will buy all of those bonds, thereby forcing Italy to default and the first giant domino to topple over.

The Italian government yesterday said that in talks with German Chancellor Angela Merkel and French President Nicolas Sarkozy, Prime Minister Mario Monti had agreed that an Italian collapse “would inevitably be the end of the euro.”

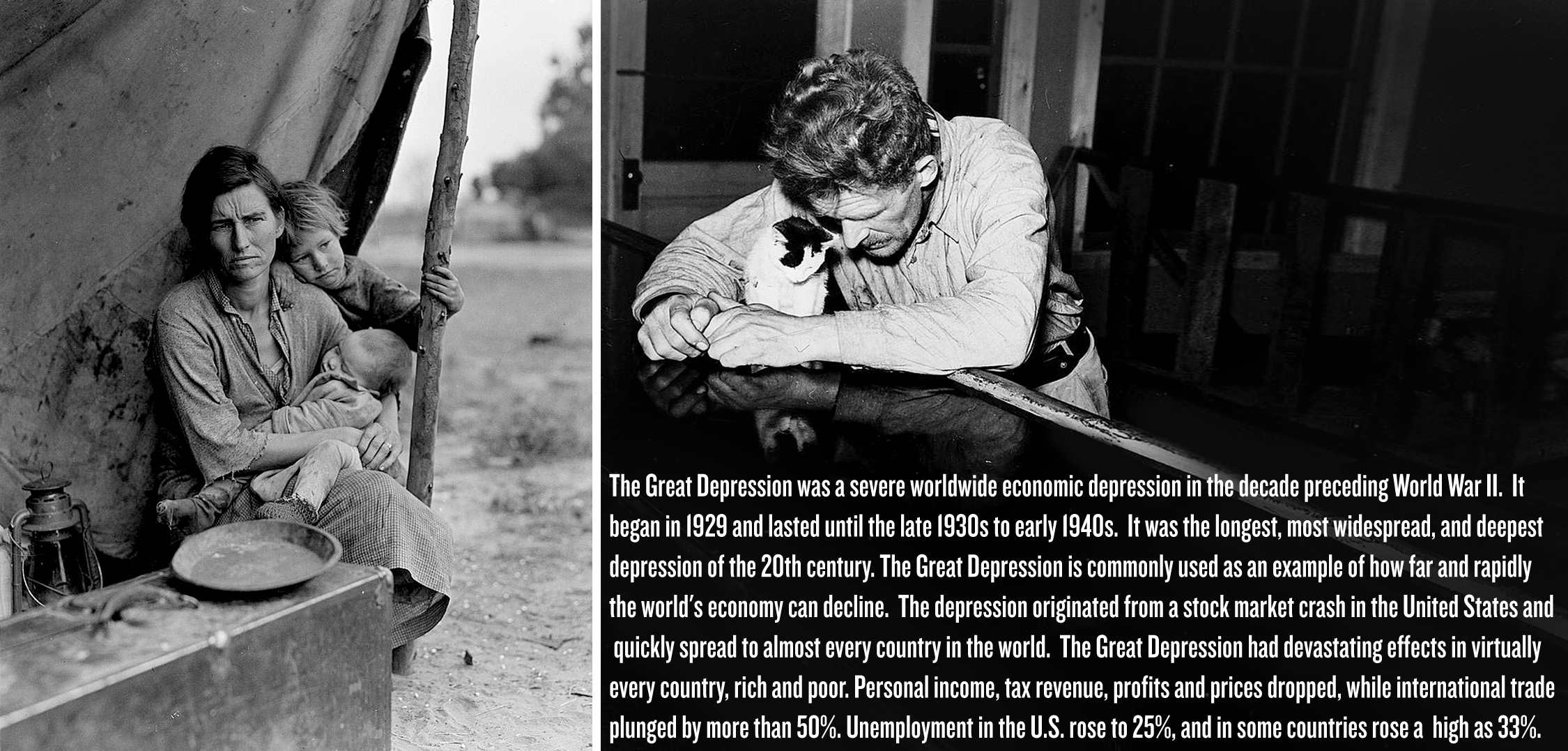

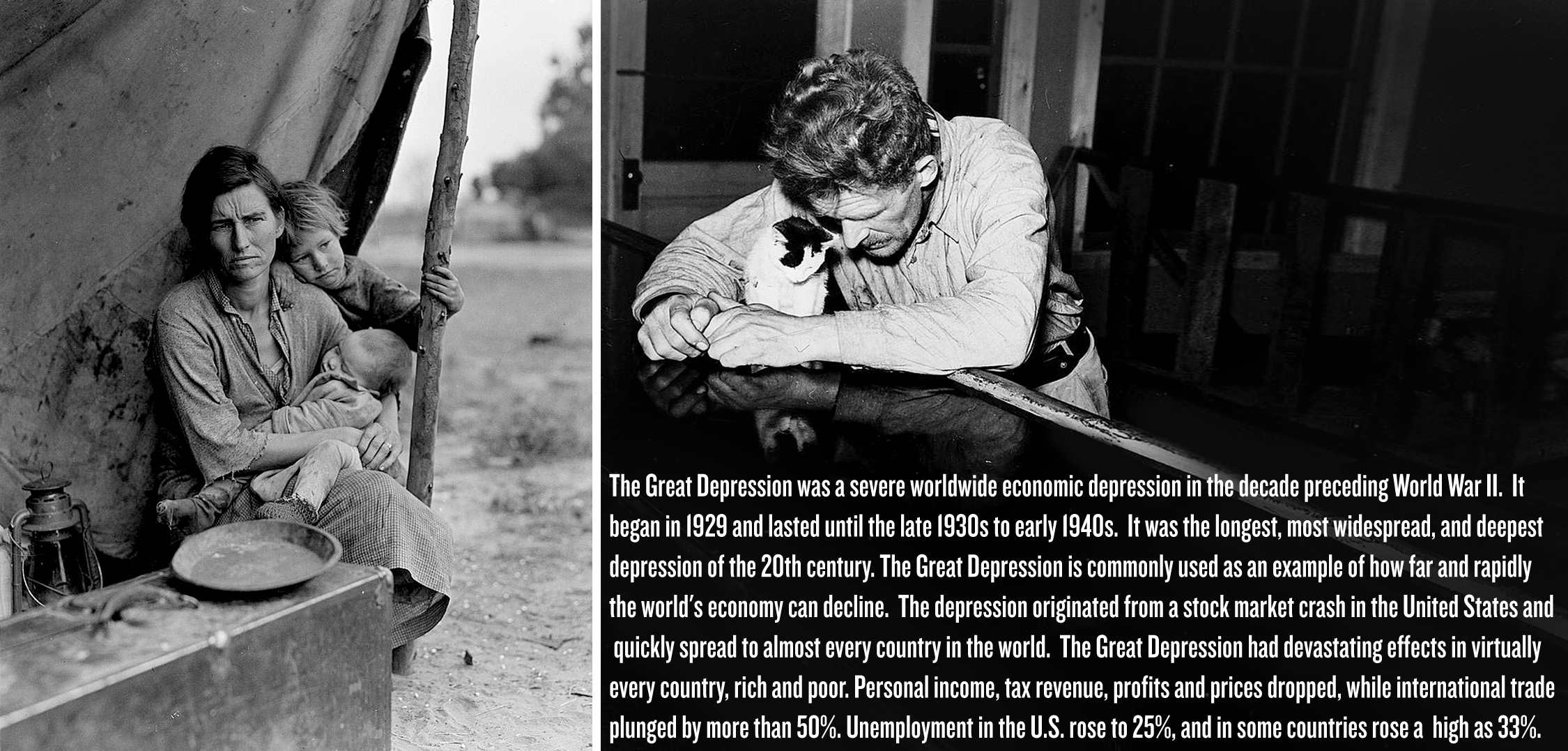

If eurozone governments defaulted on their debts, the European banks that hold many of their bonds would almost certainly collapse. Analysts warn the shockwave of such an event would lead to a collapse of the entire financial system, leaving banks unable to return money to retail depositors and destroying companies dependent on bank credit. Economists believe the outright collapse of the euro could erode the GDPs of its member-states by up to 50% and trigger mass unemployment. On Monday, November 28 2011 The Organisation for Economic Co-operation and Development (OECD) said meltdown in the single currency bloc would bring the world’s economy to its knees and make September 2008 look pale in comparison, sparking a “deep depression felt around the world.”